HELOC and Home Equity Loans: How They Work and the Benefits of Financing Home Improvement Projects

Are you considering a major home renovation or repair for your house in New Mexico? Home improvement projects have been popular during the pandemic, with everyone spending more time at home and looking to refresh and repurpose their space. Interest rates have also been historically low lately, making it a great time to tap the equity in your home for affordable financing.

In this article, we’ll explain what HELOCs and Home Equity Loans are, how they work, and the benefits of financing your next renovation. We’ll also highlight the best home projects for a return on investment. If you have questions along the way, our Santa Fe and New Mexico-based mortgage officers are here to help!

What Is A HELOC?

A Home Equity Line of Credit (HELOC) is a revolving credit account, similar to a credit card. However, a HELOC is linked to your primary checking account so that you can transfer funds to use “like cash” or write checks to contractors (for home improvement projects). HELOCs also offer a lower interest rate than credit cards because they are secured by the value of your home.

When you open a HELOC account, you don’t have to use it right away. As with a credit card account, HELOCs allow you to borrow the money you need, make payments on what you borrowed, and borrow again as long as you don’t hit the credit limit.

Read the terms of your HELOC carefully before accepting the credit offer. Generally, HELOCs come with a draw period and a repayment period. During the draw period, the line of credit can be used, paid off, and used again as mentioned above. At the end of the draw period, any remaining balance is converted to a term loan with a repayment period of 10-20 years. There may be an annual fee or a penalty fee for closing the account early. HELOCs also usually come with a variable interest rate that can rise or fall during the life of the account.

In summary, a HELOC can be a great, flexible financing option for a home repair or renovation project. You don’t have to use the full amount of your credit limit and funds are available right away as needed. So if you’re not sure how much your home renovations will cost, a HELOC offers plenty of flexibility. Just make sure you review the loan terms carefully and ask questions to make sure a HELOC is right for you and that you’ll be able to afford the payments in the repayment period, which may be higher than the minimum required payments during the draw period.

What Is a Home Equity Loan?

A home equity loan, also called a second mortgage, is a term loan, meaning you receive a lump sum upfront and repay what you borrowed over a predetermined period of time in fixed monthly payments. Because this type of financing is secured by the value of your home (as with a HELOC), the interest rate (which is usually fixed, unlike with a HELOC) is usually lower than what you’d get on an unsecured personal loan.

When you’re approved for a Home Equity Loan, you’ll receive the total amount borrowed right away and repayments will begin the following month or so. You must make on-time monthly payments, or your account could fall into delinquency. So, it’s important to make sure the monthly payments on a Home Equity Loan will fit into your budget.

Terms on home equity loans can vary from 5-30 years. The shorter the term, the larger your monthly payment will be but the less interest you’ll pay overtime. And vice versa. Because you begin repaying a home equity loan right away, it doesn’t make sense to take one out unless you already have a designated use for the funds. If you want to wait and see, a HELOC might make more sense.

HELOC vs. Home Equity Loan

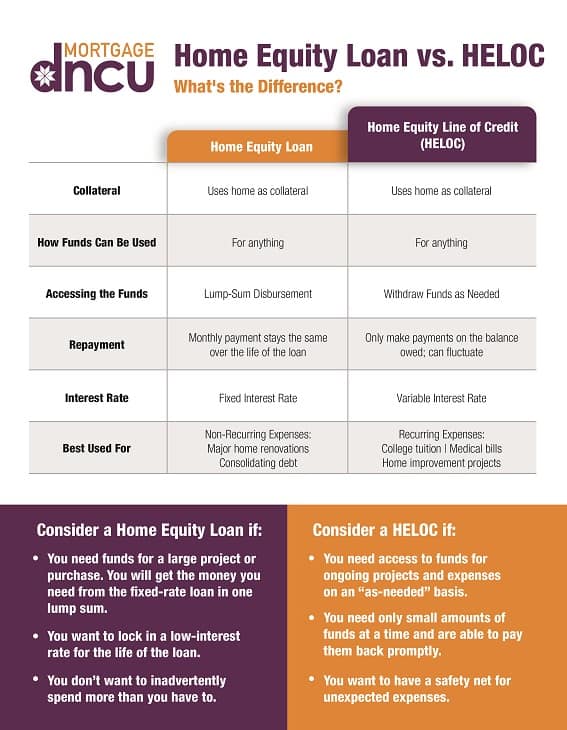

The similarities between HELOCs and Home Equity Loans are:

- Secured by the value of your home, meaning you could lose your home if you don’t repay.

- Offer lower interest rates than just about any other type of financing.

- Subject to credit approval.

- May require you to pay some closing/loan fees.

- Offer affordable financing for home improvement projects and other large expenses.

Differences between HELOCs and Home Equity Loans:

- Interest rate: Usually variable with a HELOC and fixed with a Home Equity Loan.

- Repayment: Begins right away with a Home Equity Loan and not until you make your first draw with a HELOC.

- Flexibility: HELOCs generally offer more flexibility with the ability to continue borrowing throughout the draw period and the option to make minimum payments. Therefore, a HELOC may be best for a variety of home improvement projects or when you’re not sure how much you’ll need to borrow. On the other hand, a Home Equity Loan may be easier to budget for, making it a great option when you already know the scope of your project and how much it will cost.

Benefits of Using Home Equity To Remodel

- Affordable Interest Rates: As mentioned, financing with home equity usually offers a lower interest rate than a personal loan or credit card. Contact a DNCU mortgage lender to ask about our current rates on Home Equity Loans and HELOCs.

- Tax Deduction: Interest paid on Home Equity Loans and HELOCs may be tax-deductible if the money was used to “substantially improve the taxpayer’s home,” according to the IRS.

- Return On Investment (ROI): Many homebuyers today are looking for “move-in ready.” While never guaranteed, certain renovations can help you sell your home faster and/or for a higher price (see our ROI section below).

- Preserve savings: Instead of liquidating your savings to pay for a needed home repair, borrowing against your home equity helps preserve your savings for emergencies while providing affordable financing.

How To Get The Most Out of a Home Equity Loan

- Make payments on time: As we’ve mentioned, your home serves as the collateral on a Home Equity Loan, just as it does on your primary mortgage. Falling behind on payments runs the risk of losing your home.

- Stay on budget: With loan money in your checking account just like cash, it can be easy to lose track of your spending or veer off course to spend loan money on non-renovation expenses. So get organized by creating a budget or plan for how to use funds from your home equity loan or line of credit.

- Use for Larger Projects: Home Equity Loans are best used for large-scale home improvements such as kitchen and bathroom remodels or building an addition.

How To Get The Most Out Of HELOCs

- Make payments on time: This is always important regardless of what kind of loan you have. With a HELOC, it may make sense to make payments on the principal of your line of credit in addition to the interest, so you’ll have lower monthly payments during the repayment period.

- Be mindful of fees: HELOCs often come with additional fees such as annual maintenance fees and closing costs. Read the fine print carefully so you understand any fees associated with your loan and whether they come out of the total loan value.

- Use for smaller projects: HELOCs are best used for smaller scale, ongoing or multiple projects since there is flexibility over how much you borrow during the draw period.

Home Improvements with the Best ROI

While you can’t guarantee that a home improvement project will bring ROI, this list is of the most proven projects to bring a return, especially if you’re getting ready to sell. Sources for ROI percentages are linked in the figures below.

- Minor Bathroom Remodel: 102% ROI

- Garage Door Replacement: 5% ROI

- Exterior

- Mid-Range Kitchen Remodel:5% ROI

- Basement Remodel: 1% ROI

- Upgraded Window Replacements: 6% ROI

- Deck Addition: 6% ROI

- Entry Door Replacement: 9% ROI

Additional home improvements that can add value to your home and make it more desirable for potential buyers include:

- Fresh interior paint

- Updated fixtures

- Hardwood floors

- New/updated exterior siding

- Adding smart-home technologies such as thermostats, lights, locks, etc.

Finally, it’s worth noting that the New Mexico Solar Market Development Tax Credit was signed into law in 2020, providing a 10% tax credit with savings up to $6,000 on new solar energy systems. Learn more here.

Let DNCU help you finance your next home improvement project!

We are a member-owned and community-focused credit union dedicated to improving the lives of our members in New Mexico with competitive products and an unmatched commitment to member service. Schedule your consultation with a Del Norte mortgage lender today to learn more about HELOCs and Home Equity Loans or to start your application!