Text Alerts from DNCU

Text Alerts from DNCU

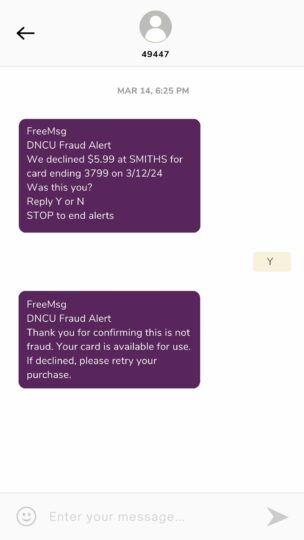

Our credit and debit card members will now receive fraud alerts if their card has suspicious activity. You might get a text, email, or phone call depending on how we have your preferred contact information. Just another way we are trying to keep your personal account safe.

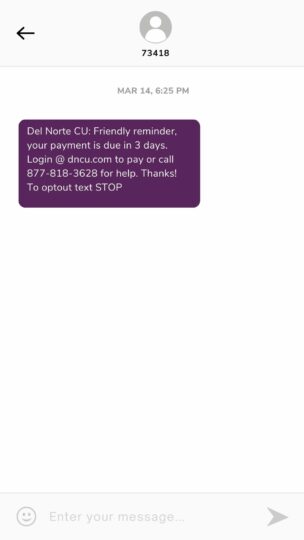

Our loan holders will also begin to receive text message reminders regarding their upcoming and late loan payments, and information regarding loan status. These texts will come three days before your loan payment is due, one day before your payment is due, and if your loan payment is late, you will receive ongoing reminders if we haven’t received your payment.

Please note that DNCU employees will never ask you to provide sensitive information via text. Contact us directly at (505) 455-5228 with any questions about your account status.

Here are a few examples of what these texts may look like:

FAQs

Q: What are fraud alerts?

A: Fraud alerts are automated phone calls, text messages and emails that are sent when potentially fraudulent purchase activity has been detected on a credit/debit card account. Messages are triggered by the Del Norte Credit Union fraud detection system.

Text messages will be sent to cardholders in the 50 United States at no charge.

Customers with international telephone numbers will only receive emails. They will not receive text messages or phone calls.

Q: Why am I receiving a fraud alert?

A: Fraud alerts are sent to cardholders when potentially fraudulent transactions are detected on their accounts. We want to ensure that any questionable transactions were authorized by the cardholder.

Q: Will fraud alerts contain any personal information?

A: We will not transmit sensitive personal information through alerts.

Q: Will I get fraud alerts while I am traveling domestically/internationally?

A: If you are traveling within the U.S., you will receive phone calls, text messages and emails. If you are traveling internationally, you will receive emails. You will only receive text messages if your mobile phone plan allows you to receive them while traveling outside of the United States.

Q: What phone number(s) will receive fraud alerts?

A: Any phone numbers that Del Norte Credit Union has in your records may be sent alerts.

Q: How do I update my contact information (phone numbers, email addresses, etc.)?

A: You can update your contact information by updating your account profile in digital banking, by calling the number on the back of your card, or by visiting a branch.

Q: How do I stop receiving fraud alerts? What should I do if I don’t want to get a fraud alert at a certain phone number?

A:

- You can opt out of text alerts by replying “STOP” to the text message

- You can opt out of phone calls when the alert system calls you.

- Click on the Unsubscribe link in the email to stop the emails.

- Contact our Call Center to ask to stop receiving fraud alerts.

- Visit a branch to ask to stop receiving fraud alerts.

- I accidentally opted out of receiving fraud alerts.

Q: How do I opt back in?

A: If you accidentally opted of out text alerts from a mobile phone, when the digital system calls to verify activity, the system will provide the opportunity to opt back into text alerts for the mobile phone. For all fraud alert types, please call the number on the back of your card to re-enable fraud alerts to an email address, a mobile phone or landline phone number. You can also visit a branch for assistance.

Q: I have a joint account with another cardholder. Why did I not receive a fraud alert? (Or: Why am I receiving fraud alerts when someone else on my account is making a transaction?)

A: Fraud Alerts are transmitted to the phone number(s) and/or email address associated with the card used at the time of the transaction. If a joint cardholder is receiving alerts, it is because that cardholder’s phone number and/or email address is associated with the card transacting. If the fraud alerts should have gone to another cardholder on your account, we ask that you update the contact information for that cardholder.

Q: A legitimate transaction triggered a fraud alert. How long should I wait after responding to an alert to reattempt the transaction?

A: Upon confirming that a transaction is valid, you may retry the transaction immediately.

Q: I accidentally marked a valid transaction as fraudulent. What do I do now?

A: When you mark a transaction as fraudulent, the response message you receive will include our fraud detection department’s toll-free number and it asks that you call to review the card activity, or you will receive a call from a fraud detection agent to review. The agent will be able to review the activity with you and clear the card for use.

Q: I accidentally responded to an alert that a fraudulent transaction was valid. What do I do now?

A: Please report the unauthorized transaction immediately by calling the phone number provided in the alerts or the number on the back of your card. The agent will then take care of marking the transaction as fraud and close the card.